Moving Average Strategy in 2020 Moving average, Strategies, Forex

3. Moving Average. A moving average is one of the most popular technical indicators. In the chart below, we can see how scalpers use Exponential Moving Averages (EMAs) to establish positions. EMA is a type of moving average that places a greater weight and significance on the most recent data points.

Best Moving Average for 1 Minute Chart Scalping Forex

1. Moving Average Crossover Strategy: The moving average crossover strategy is one of the simplest and most effective forex scalping strategies. It involves using two moving averages, typically a faster one and a slower one. When the faster moving average crosses above the slower moving average, it generates a buy signal, and when it crosses.

Moving Average 1 Minute Scalping Strategy [ EMA + Price Action + Momentum ] YouTube

The purpose of using moving average indicators in a scalping strategy is to identify optimal entry points. To do this we use two indicators, a 200SMA a 20EMA. The purpose of the SMA is to plot the longer-term trend line and to trade only when price action is in line with the underlying trend. For instance, if the long-term trend is bullish, a.

Forex Moving Average Scalping Strategy Forex Millennium System

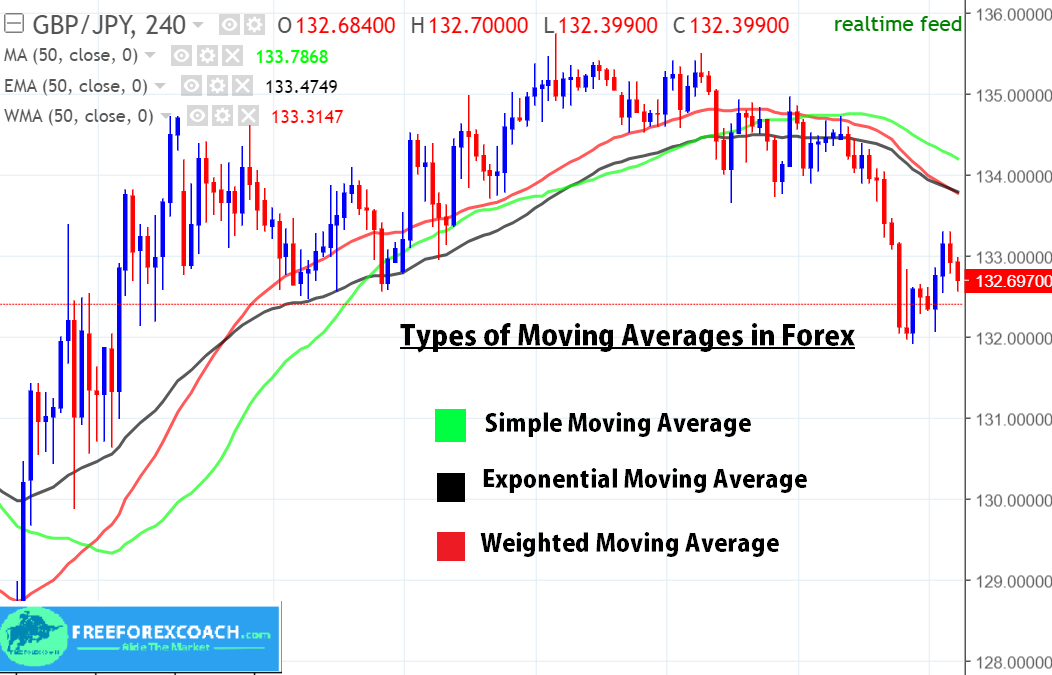

Exponential moving average (EMA) EMA is a type of moving average that gives more weighting for the most recent data. It is a common scalping indicator because it reacts faster than the simple moving average (SMA). There are several strategies for using it when scalping. For example, you can place a buy trade when an asset crosses the moving.

What is the Popular Moving Average Scalping Strategy?

Here's an example of a simple moving average (SMA) strategy that you can use for forex scalping: Indicators: 10-period SMA (Simple Moving Average) 20-period SMA. Timeframe: 1-minute or 5-minute charts (for quick trades) Entry Rules: Wait for the 10-period SMA to cross above the 20-period SMA, indicating a potential uptrend.

How Forex Market Moves Fast Scalping Forex Hedge Fund

Moving Average Strategy: Moving averages can provide scalpers with a meaningful data set. For example, a five-day Simple Moving Average (SMA) adds up the five most recent daily closing prices and divides the figure by five to create a new average each day. Exponential Moving Averages place greater emphasis on recent prices. Both can be useful.

Forex Scalping Strategy and the Best Moving Average for 1 Minute Charts

50-Period exponential moving average; 100-Period exponential moving average; Stochastic oscillator with a setting of (5,3,3) Strategy Overview. Let's take a look at the 3 main steps of our 1-minute Forex scalping strategy. Step 1: Identify the short-term trend. The two moving averages are used to identify the current trend in the 1-minute.

Best EMA for Scalping Moving Average (EMA) Scalping Strategy

Moving Average Ribbon strategy. This scalping strategy involves the use of several EMAs with different time frames. For example, scalpers generally use 10 EMA, 20 EMA, 50 EMA, and 100 EMA. The EMAs are then plotted on the chart in a ribbon-like formation, running parallel. This ribbon can be used to identify the direction and momentum of the trend.

Scalping Trading Strategies With PDF Free Download

5-8-13 Moving Averages. The combination of five, eight, and 13-bar simple moving averages (SMAs) offers a relatively strong fit for day trading strategies. These are Fibonacci -tuned settings that.

1 Min Easy Forex Scalping Strategy

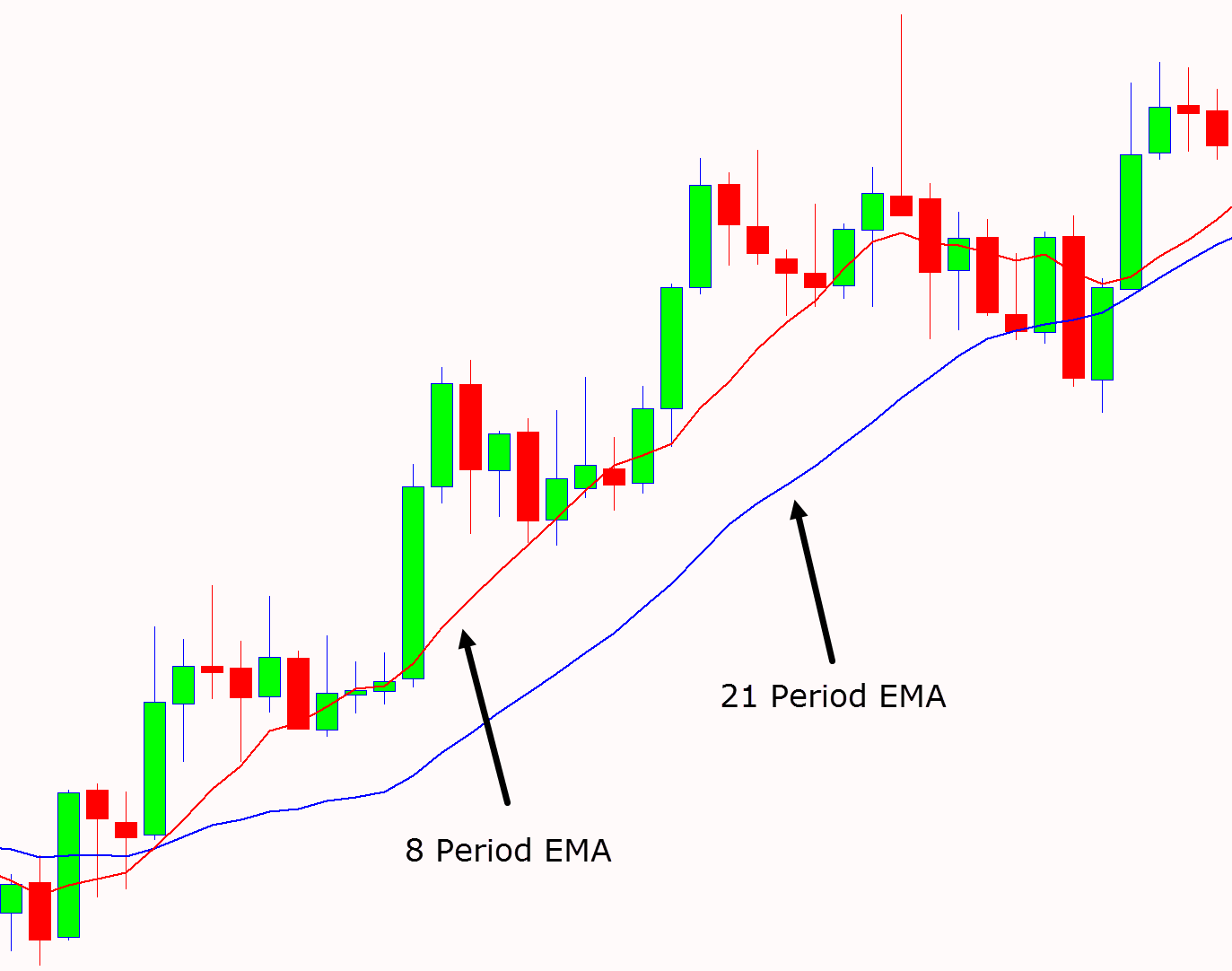

The 8-period exponential moving average was moving above the 21-period one. We switched to M5 and waited for the candlestick to test the 8-period EMA by its lower shadow. When the trigger candlestick occurred, we counted five candlesticks from the trigger one and chose the one with the highest high.

Types of Moving Averages in Forex Free Forex Coach

Simple Moving Average Scalping Indicator for Forex Signals. The simple moving average shows the average price over a specific time period allowing you to know if the price is going up or down, thus identifying a trend. So, for example, if you wanted to plot the 7 period on a 10-minute chart, you would add all the closing prices of the last 70.

Scalping With Moving Average YouTube

The moving average scalping strategy is a time-tested approach that can skyrocket profits in short-term trading. By leveraging technical analysis and utilizing the power of moving averages, traders can capture quick gains and capitalize on intraday price movements in forex and stocks.

Moving Average Scalping Strategy Skyrocket Your Profits With This TimeTested Approach

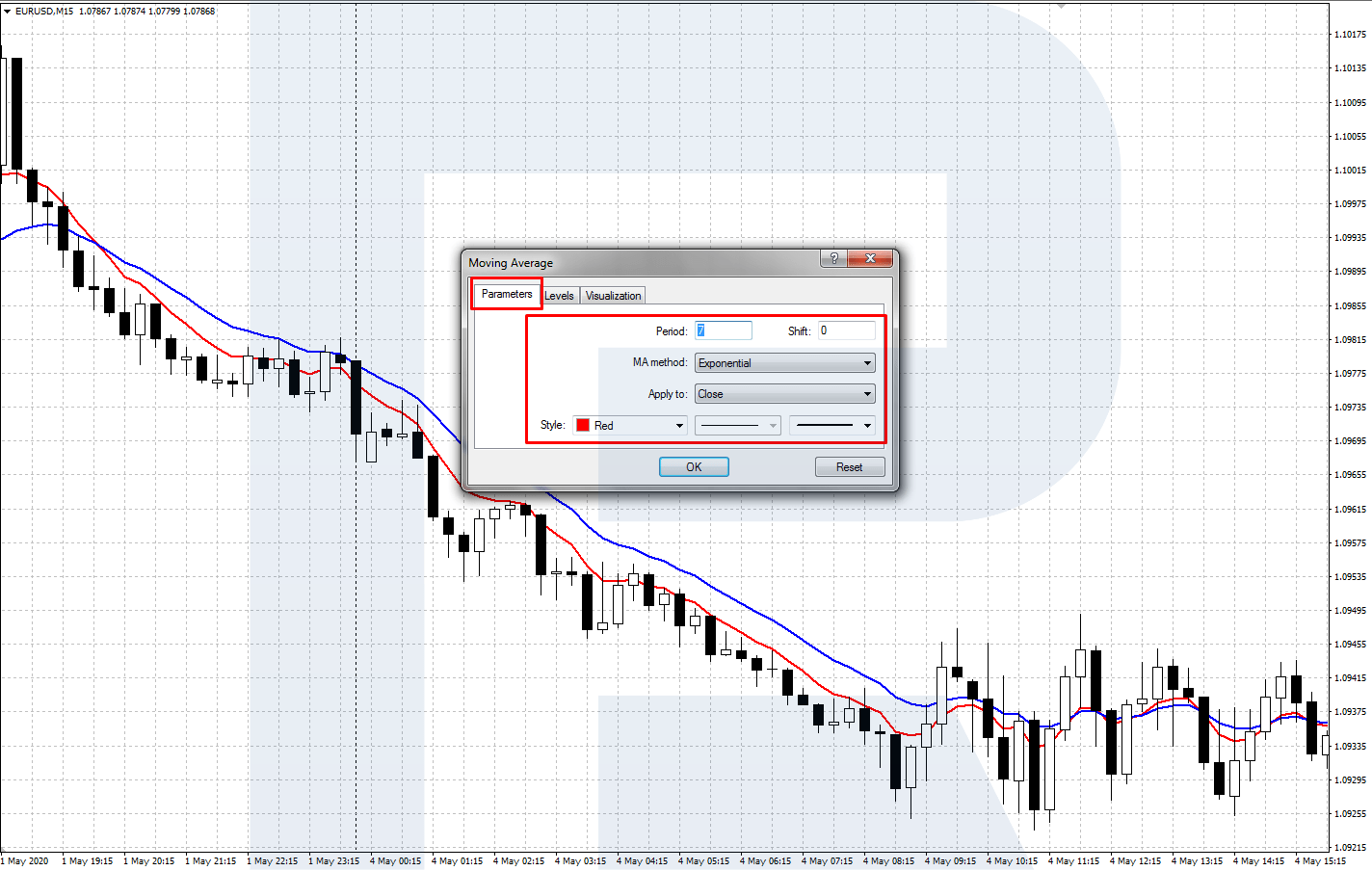

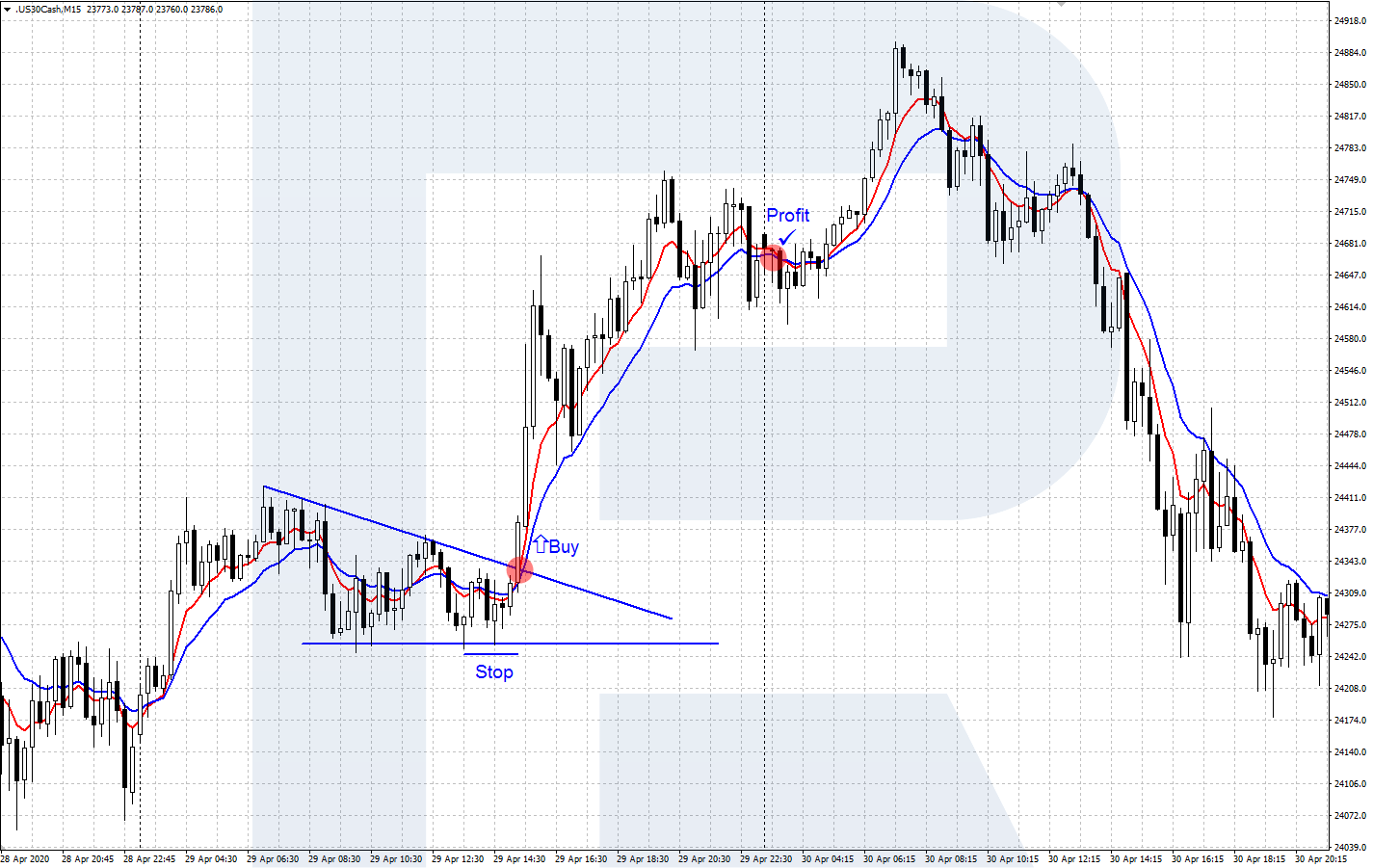

The main timeframes are M5 and M15. Place a fast EMA (7) (red) and a slow EMA (14) (blue) on the chart. In popular terminals, including MetaTrader 4 and MetaTrader 5, you can do this via the Main Menu: Insert - Indicators - Trend - Moving Average. In the setting window, choose periods 7 and 14, the Exponential averaging method, Applied to: Close.

Forex Scalping Strategy With Exponential Moving Average

Strategy #1 - Pullbacks to the Moving averages. We discuss this in detail in a post on 20 Moving Average Pullbacks. It can be a very lucrative strategy on any time frame. In a nutshell, it is a scalping strategy that is focused on joining a trend in either direction by jumping into a stock as it pulls back to a popular moving average.

What is the Best Forex Scalping Strategy? The Forex Geek

Moving Average Scalping Strategy is a popular forex trading approach that aims to potential opportunities from small price movements in the currency markets. This strategy involves using one or more moving averages, which are commonly used indicators in technical analysis, to identify short-term trends in the market.

Teknik Scalping Panduan Penuh

Traders must pick periods in which to create moving averages to identify price trends. Common periods used are 100 days, 200 days, and 500 days, for long-term support, and five days, 10 days, 20.